I will tell you about the trick that we use in EDVI trade to improve the profitability of some trading bots.

It’s called “Risk Limit.”

- The essence of Risk Limit is to replace fixed risk with smaller risk, but with the application of a conservative multiplier after a loss.

- The key feature is the presence of a strict limit above which the risk will not rise. This limit should also remain in the low-risk zone.

Let me explain with an example.

Let’s imagine that in each trade we risk a fixed 2% of the deposit. We want to apply Risk Limit!

Here’s how we do it:

- Reduce the risk to 1%.

- Apply a multiplier of x1.2 after each losing trade.

- Return to 1% after the first profit.

- Set the upper limit at 3% and do not risk more under any circumstances! We maintain this percentage until the first profit.

The resulting risk range, rounded to tenths, looks like this:

1%, 1.2%, 1.4%, 1.7%, 2.1%, 2.5%, 3%.

What are the advantages compared to a fixed risk of 2%?

1️⃣ The initial risk is lower, which means lower leverage, commissions, and other associated costs.

2️⃣ Most trades close at the initial steps. Few reach risks of 2-3%, which is also not critical.

3️⃣ Smoothed income pattern. Higher recovery factor and other qualitative characteristics of the trading system.

I will supplement with an illustration in the screenshots.

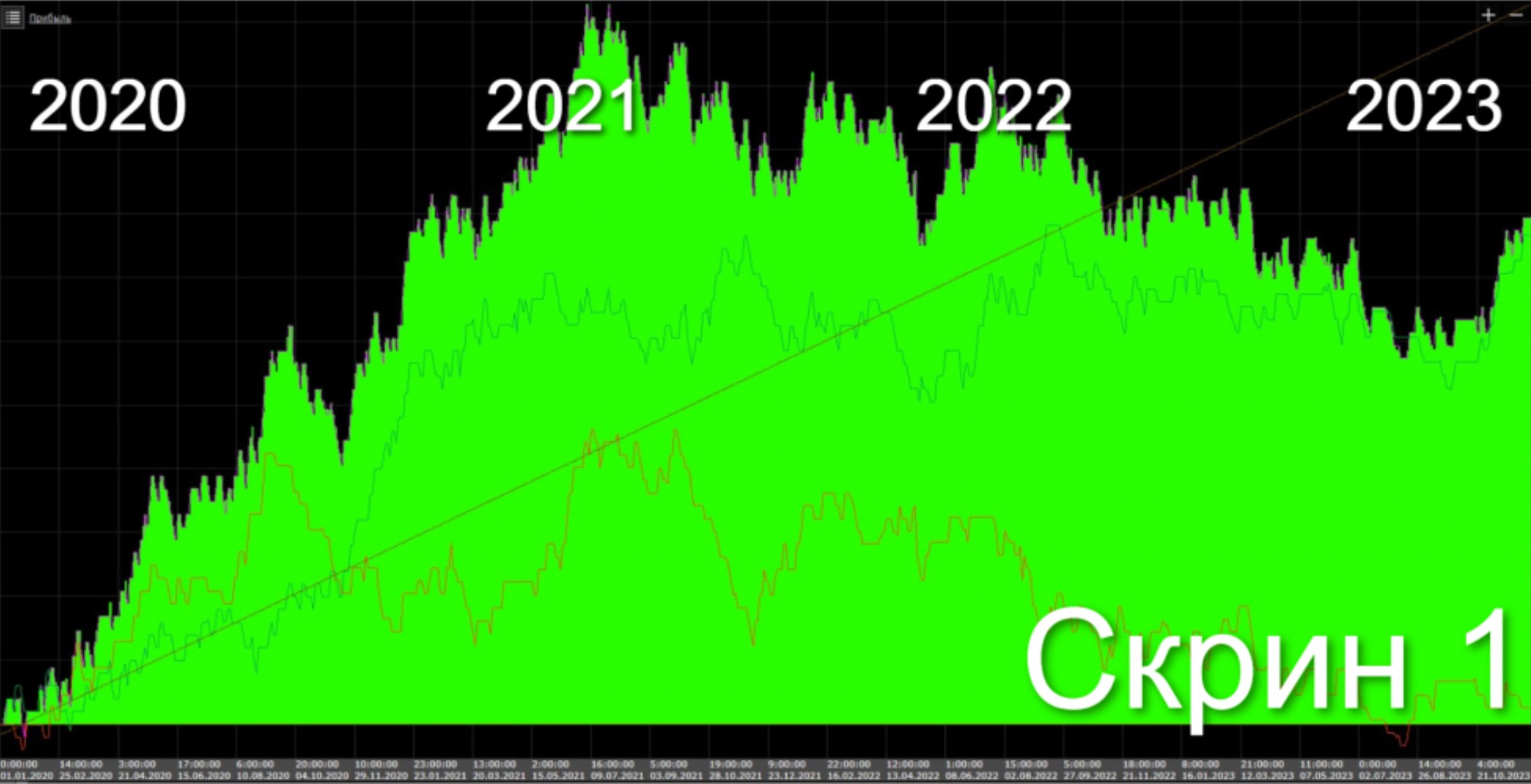

Screenshot 1 (fixed risk).

A regular breakout on Ethereum, D1.

Take to stop 4 to 2. Risk per trade: 2% of the deposit.

What do we get?

Stable earnings in the bull market of 2020-2021, a sad loss in the bear market and sideways market of 2022-2023.

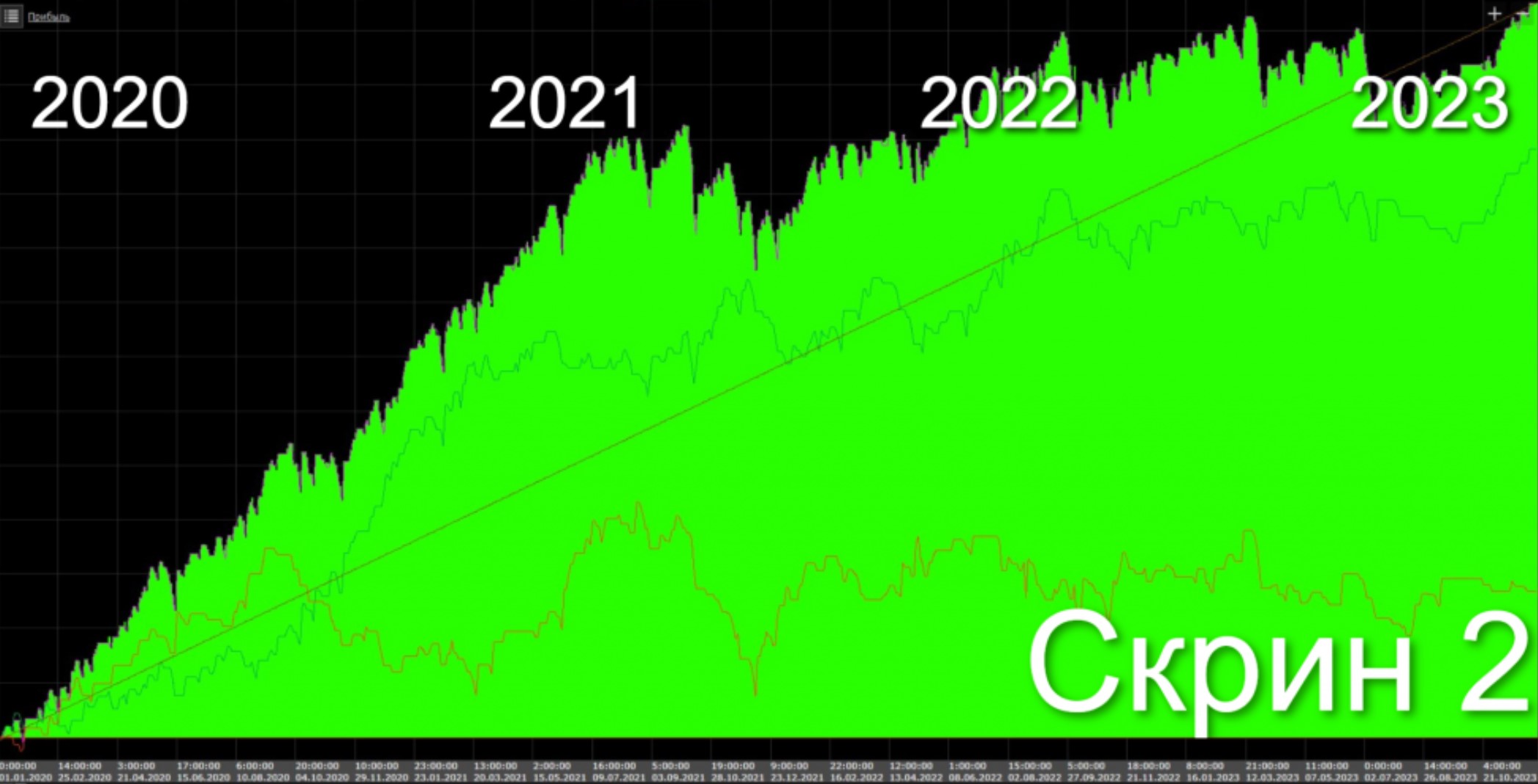

Screenshot 2 (RISK LIMIT).

The same strategy.

Initial risk: 1%. Multiplier x1.2 after a loss. Limit at 3%.

What do we get?

Earnings stabilized throughout the entire period. A near-zero (“trash”) strategy turned into a profitable one.

Risk Limit is a versatile, profitable, easily scalable technique. It can be applied in both algorithmic trading and manual trading.