Certainly, here’s a response for the FAQ section addressing proof of trading results:

What Proof of Trading Results is Available?

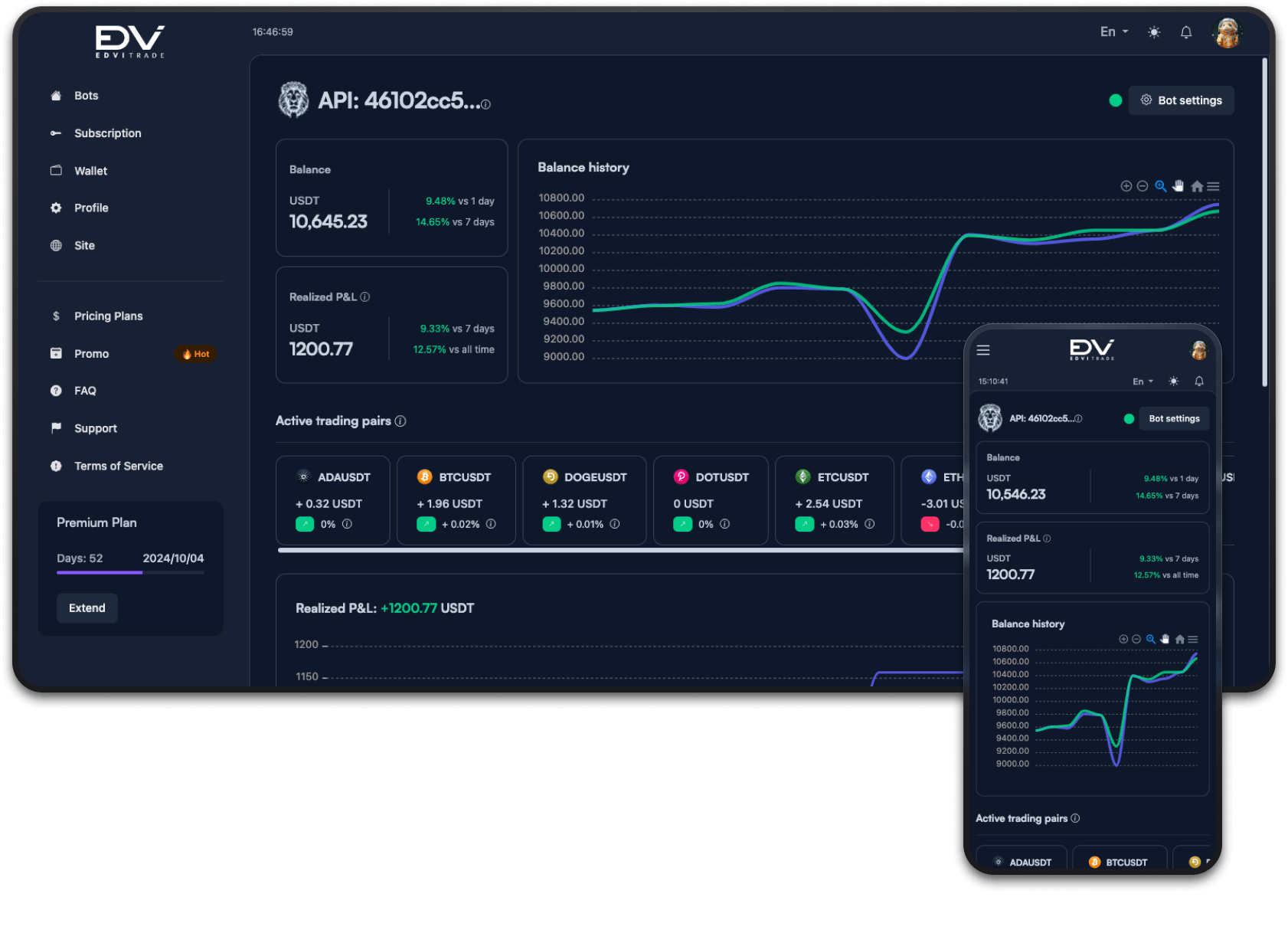

To ensure transparency and build trust with our users, we provide verifiable proof of our trading results. Here’s how you can access and verify our trading performance:

- Verified Performance Reports:

– We maintain detailed and verified performance reports that highlight our trading results over different time periods. These reports include key metrics such as profit and loss, win rates, and average returns. - Third-Party Verification:

– Our trading results are verified by reputable third-party platforms. This adds an additional layer of credibility and ensures that the results presented are accurate and unbiased. - Accessing Proof of Trading Results:

– You can view detailed trading results and performance metrics by visiting the following link: Bots. This link provides access to our trading portfolios, showcasing live and historical performance data. - Transparency and Updates:

– We believe in complete transparency. Our trading results are updated regularly to reflect the most recent performance. This allows you to track our progress and assess our strategies over time. - Customer Testimonials:

– In addition to performance metrics, we also share testimonials from our users who have experienced success with our trading strategies. These testimonials provide real-world insights into the effectiveness of our approach.

Conclusion:

We are committed to providing clear and verifiable proof of our trading results to help you make informed decisions. Visit our Bots page to explore detailed performance data and learn more about our trading success.

If you have any questions or need further clarification, please do not hesitate to contact our support team. We are here to assist you!

Up to 10 connectable bots

Up to 10 connectable bots